CFOs and FP&A leaders cannot rely only on revenue growth to measure success. True performance comes from understanding profit metrics—the formulas and measures that reveal which products, services, or customers actually create sustainable value, and more important, how to predict the values that create them.

What is a Profit Metric?

A profit metric is a financial measurement that goes beyond simple sales figures to show the real contribution to profitability. While revenue tells you how much you sell, profit metrics tell you how much you keep after costs, overhead, and resource consumption are considered.

These insights allow CFOs, Controllers, and FP&A leaders to:

- Identify profitable and unprofitable customers

- Optimize product portfolios

- Identify potential opportunities and missed opportunities

- Support strategic pricing and marketing decisions

- Align business units with the company’s profit formula

Types of Profit Metrics

Profit metrics can take several forms, depending on the level of detail you need:

- Product Profitability – Identifies which products generate the highest cost margin formula and where margins are leaking.

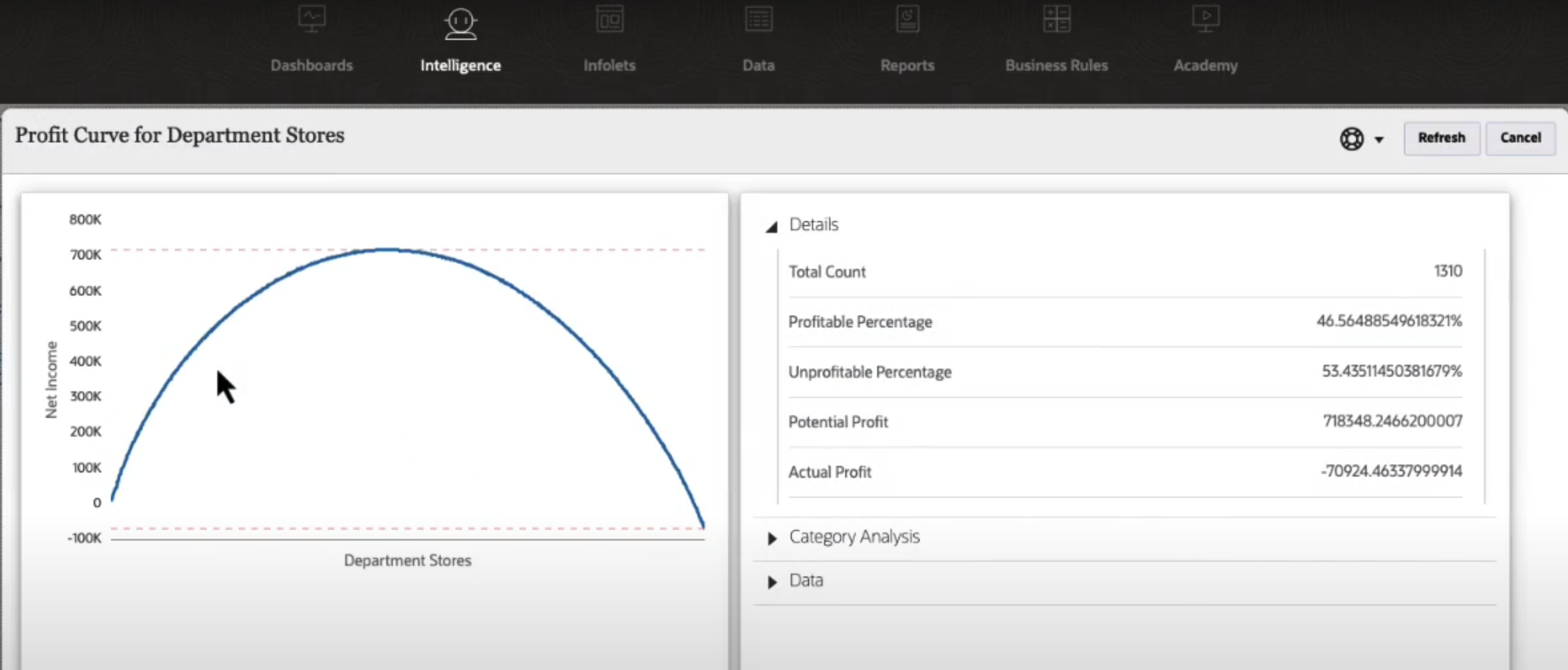

- Customer Profitability – Goes deeper than revenue by revealing direct product profitability and which clients truly contribute to the bottom line.

- Channel or Market Profitability – Helps you assess whether a region, sales channel, or campaign is creating incremental profit.

- Service Line Profitability – Particularly relevant in professional services, this measures how efficiently resources are consumed compared to revenue.

Profit Metrics in Oracle Enterprise Profitability and Cost Management (EPCM)

Oracle Enterprise Profitability and Cost Management (EPCM) equips finance teams with advanced tools to measure and analyze profitability across all dimensions of the business. Instead of working with approximations, EPCM enables you to model your profit formula with precision and transparency.

Examples of profit metrics that EPCM provides include:

- Incremental Profit Formula – shows the impact of launching a new product or service.

- Cost Margin Formula – highlights how overhead allocation affects product margins.

- Direct Product Profitability – isolates true product performance after considering logistics, service, and marketing costs.

- Customer Segment Profitability – uncovers hidden losses from unprofitable customer groups.

With these insights, decision-makers can move beyond spreadsheets and achieve predictive profitability planning, directly linking financial results to operational drivers.

Why Profit Metrics Matter

For CFOs and FP&A leaders, adopting a profit metrics approach means shifting from intuition-driven decisions to data-driven profitability management. EPCM not only provides visibility but also gives you the confidence to:

- Invest in the right growth opportunities

- Discontinue or restructure unprofitable operations

- Align financial planning with strategic goals