Many organizations still rely on traditional volume-based costing methods. These approaches spread overhead costs using simple drivers such as labor hours, revenue, or units produced. At first glance, this seems practical. But in reality, it often produces wrong profit metrics.

Why Volume-Based Costing Fails

- Arbitrary allocations: Overheads are spread evenly, ignoring how resources are truly consumed.

- Cross-subsidization: Profitable products look less profitable, while low-margin products seem better than they are.

- Static and backward-looking: Traditional costing only reflects past averages, not future uncertainties or risks.

This means managers often rely on distorted product profitability data—risking poor pricing, misdirected investments, and profit erosion.

How LCC and ABC Transform Profitability

Life-Cycle Costing (LCC) and Activity-Based Costing (ABC) provide the solution:

- True cost transparency: Costs are traced to the real activities driving them, improving the profit formula accuracy.

- Predictive profit metrics: LCC incorporates the full product life cycle—including risks, energy use, and future compliance costs.

- Direct product profitability: With ABC, organizations understand exactly which products and customers create value, and which destroy it.

From Wrong Metrics to Predictive Profitability

At Asher & Company, we implement LCC and ABC through Oracle PCM and EPCM, giving Nordic and Global businesses the tools to shift from hindsight to foresight. Instead of chasing outdated averages, our clients achieve reliable profit metrics that account for uncertainty—protecting margins and guiding smarter decisions.

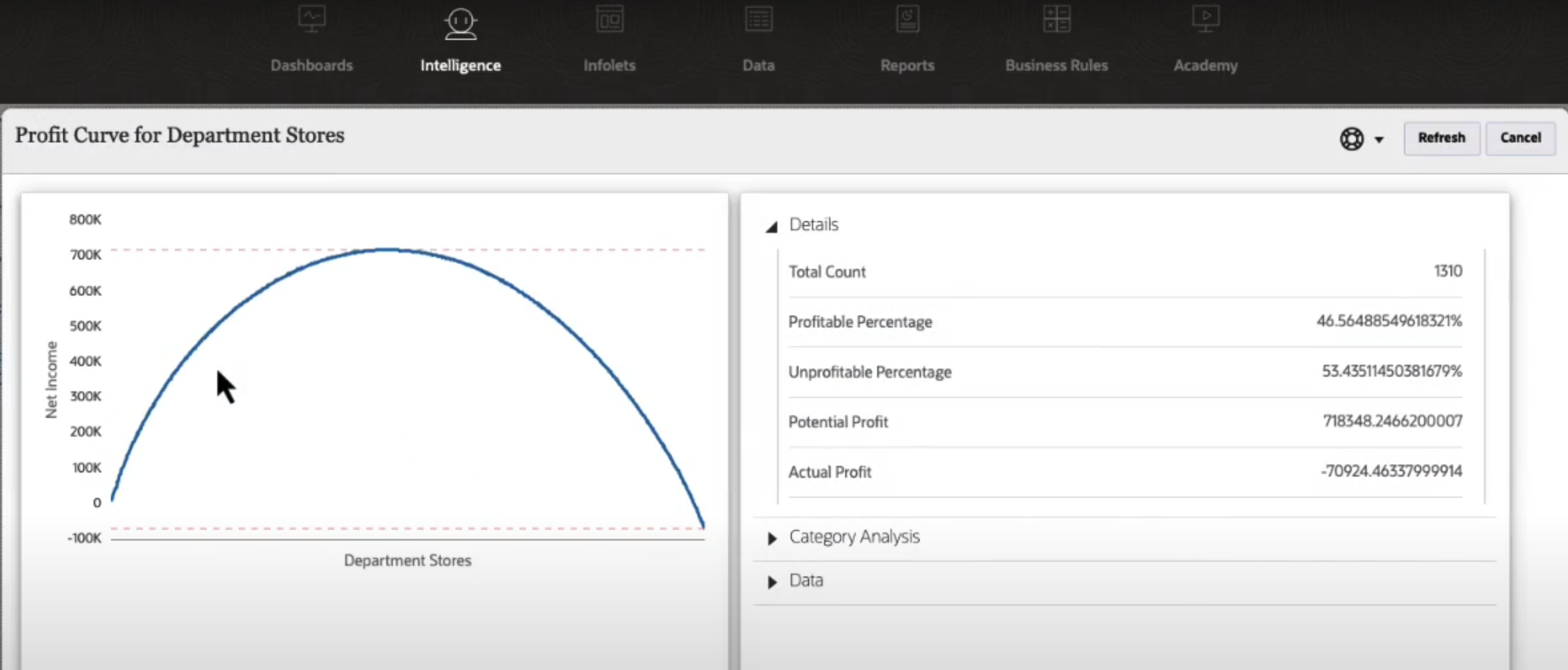

Failing to move away from traditional costing risks leaving your company with “islands of profit in a sea of red ink”—where only a few products sustain profitability while others silently erode it.