A fictionary story about how companies operating between the U.S. and Norway must treat tariffs: not as external shocks, but as inputs into the core of Enterprise Performance Management.

Introduction

“Can someone explain how we lost 220 base-points of margin—on a product that didn’t change suppliers or volume?”

The question stayed in the air as the CFO leaned forward, scanning confused faces around the conference table during the quarterly performance review with the maritime equipment division in Oslo. What had initially appeared as a routine deviation was actually the canary in the coal mine: a 15% tariff imposed by the U.S. on select Norwegian exports had silently eroded their cost structures while the business continued to plan as if operating in the same old predictable environment.

Finance hadn’t modeled it. Sales hadn’t adjusted prices. Operations had written it off as a temporary headache that would soon disappear.

It wasn’t going anywhere.

I’ve witnessed this scenario play out repeatedly in boardrooms across the Nordics. Like many transatlantic firms, the tariff didn’t hurt because it existed—it hurt because nobody had integrated it into their thinking. Instead of treating tariffs as mere background noise, organizations need to process them as fundamental structural signals—just as they would with interest rates or raw material prices. That’s precisely where robust Enterprise Performance Management (EPM) becomes essential.

The Problem: When Trade Becomes a Core Business Variable

For decades, trade between Norway and the U.S. was as stable and predictable as the Norwegian fjords—mature, low-risk, and taken for granted. That comfortable reality shattered in early 2025 with a sudden 15% U.S. tariff on several Norwegian product categories.

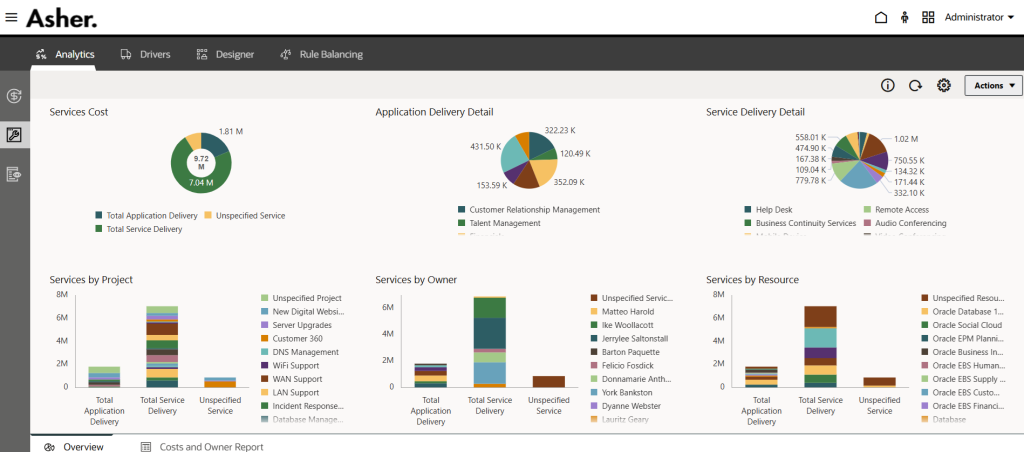

What changed wasn’t just cost—it was strategic visibility. Their Profitability & Cost Management (PCM) module of their Enterprise Performance Management (EPM) system meticulously calibrated to simulate oil prices and currency fluctuations remained frustratingly silent on tariff exposure. Forecasts missed targets. Pricing strategies failed to react. Margin erosion was absorbed rather than explained, like a slow leak nobody noticed until the tire was flat.

This story is fictionary, but this could be happenning to your company as tariffs are no longer just a footnote in trade policy. They will become a critical variable that can make or break your quarterly numbers.

TRADE SNAPSHOT: Norway–U.S. Under Pressure

- Tariff Rate: 15% imposed on selected exports (Q1 2025)

- Key Impact Sectors: Maritime equipment, specialized metals, industrial tech, clean energy components

- Annual Trade Volume: $10.6B (2024), with 37% in tariffed categories

- Estimated EBIT Impact: Up to -2.4 percentage points for companies with 30%+ U.S. exposure

A Framework for Action: Profitability & Cost Management

1. From Awareness to Modeling

Treat tariffs like other foreseeable financial impacts (currency exchange rates, inflation, etc.): forecast them, anticipate scenarios, and model their impact with the same rigor.

- Add tariff exposure to SKU-level margin models—yes, every single product line that crosses borders

- Run quarterly what-if scenarios with trade-specific assumptions (What if tariffs rise even more or diminish? What if they extend to new categories? What non-quantitative impacts could create?)

- Automate regulatory updates into forecast drivers rather than treating them as one-time adjustments

- Add simulation and Machine Learning to your Performance Management, along automated anomaly detection alarms.

- Create tariff dashboards showing exposure heat maps by product line, customer, and geography

We recently worked with a marine tech provider who implemented this approach and discovered 42% of their portfolio had significant tariff vulnerability—a revelation that drove immediate action.

2. From Finance-Only to Cross-Functional Ownership

Tariffs hit everyone—from the loading dock to the executive suite. Responsibility must be shared across the organization.

- Assign “tariff champions” in finance, operations, and sales—actual names, not just departments

- Surface tariff risks during forecast meetings and pricing cycles with standardized reporting

- Review jointly during Performance Management cadence reviews, with accountability metrics for response time

- Create cross-functional trade committees that meet monthly (not quarterly—that’s too slow)

“We realized our trade compliance team was isolated in a silo, speaking a language nobody else understood,” admitted the COO of a Norwegian industrial automation company.

“Breaking down that wall between compliance and finance was our most important move.”

3. From Short-Term Shock to Intertemporal Strategy

Tariffs affect time horizons differently, and your response should be calibrated accordingly.

- Short term (0–3 months): Logistics optimization, bonded warehousing, strategic stockpiling before implementation dates

- Midterm (3–12 months): Pricing adjustments, SKU rationalization, HTS code reviews

- Long term (12+ months): Contract redesign with tariff escalation clauses, supplier rebalancing, selective reshoring

What Happens When You Don’t Integrate Tariffs into your Cost Management review process ?

⚠️ Case 1: The Forecast Miss

Industry: Offshore machinery

Missed margin forecast by -6.2% because tariffs were absent from EPM models. Finance only discovered the issue during post-close analysis—far too late to take corrective action.

Critical Error: Treating tariffs as a simple accounting line item rather than a forecast driver that ripples through the entire business.

⚠️ Case 2: The Pricing Disconnect

Industry: Clean energy components (California/Oslo operation)

Product pricing was locked in with major U.S. customers before finance had adjusted models for the 15% tariff. Profitability collapsed mid-contract, with no contractual recourse.

Critical Error: No established feedback loop between finance, procurement, and the pricing team when trade conditions change.

“We were essentially subsidizing our U.S. customers without realizing it,” their commercial director told me over coffee last month. “By the time we understood what was happening, we’d already committed to pricing that was underwater.”

⚠️ Case 3: The Slow Reroute

Industry: Industrial tech manufacturer (Oslo)

Management was aware of tariff risk early on but delayed decisions on rerouting production or reclassifying products while waiting for committee decisions and “perfect information.”

Critical Error: Over-reliance on slow governance cycles for fast-moving trade risks, creating analysis paralysis.

📌📌📌 Tariff Blind Spots in EPM – And How to Fix Them

From Alert to Action: Five Moves for FP&A Leaders

1. Name the Exposure Champions

Assign clear roles to own tariff exposure and updates—with names, not just titles. Make it part of their performance metrics and compensation.

2. Model Tariffs into COGS and Forecasts

Treat them like currency exchange: embed them structurally into your fundamental calculations, not as after-the-fact adjustments.

3. Run Pricing Stress Tests

What happens if your top 10 SKUs face 15% tariffs tomorrow? Can your margins absorb it? Can your customers? Do this exercise monthly.

4. Pre-Authorize Strategic Levers

Don’t wait for perfect information. Include specific authorization for bonded warehousing, HTS reclassification, and route changes in your contingency playbooks.

5. Train for Interpretation, Not Just Awareness

It’s not enough to know a tariff exists—your team needs to understand the business impact. Run simulation workshops with real numbers from your business.

A manufacturing client recently told us, “We used to treat trade policy like weather—something that happens to us. Now we treat it like interest rates—something we actively model and manage.”

Conclusion: Trade Volatility Is Now Performance-Relevant

Asher has worked with dozens of CFOs, FP&A and Cost Management leaders across industries, from Oslo to San Francisco. The pattern is painfully clear: tariffs are not a reporting issue or a compliance headache. They’re a strategic blind spot—until they hit margins.

The question is: will your organization plan for them, or just react to them?

If your Cost Management (PCM) or EPM systems can integrate inflation, currency fluctuations, and interest rates—it can handle tariffs. But only if you decide to make them visible and actionable. The companies that win in today’s volatile trade environment won’t be the fastest reactors. They’ll be the best integrators.

Ready to start your Profitability Journey ?

Learn More

Article written by Pedro San Martín

Pedro is an expert in Cost Management with more than 25 years of experience, currently leading the Profitability & Cost Management (PCM-EPM) practice for PwC Interaméricas and Asher & Company Nordics, and has been President and Founder member to the Institute of Management Accountants (IMA) Spain Chapter, currently being Cost Management remote professor at the University where he earned his CPA.

This article reflects views from our work with over 30 global businesses navigating tariff and other cost-reduction challenges. For company/industry-specific analysis, please reach out directly.

References

- USTR – ustr.gov/trade-agreements

- WTO G20 Trade Measures – wto.org/english/news_e/archive_e/trdev_arc_e.htm

- Bloomberg – “US Tariffs on Norwegian Sectors Shake Maritime Industry,” Feb 2025

- Reuters – “Norway Seeks Tariff Exemptions in Washington Talks,” March 2025

- Spectrum News – “Trump Administration Announces 15% Tariffs on European Allies,” April 2025

- McKinsey & Company – “Navigating Tariffs with a Geopolitical Nerve Center,” 2025

- OECD Trade Dashboard – oecd.org/trade/topics/monitoring-trade