Cost per Patient is one of the most valuable yet elusive goals for healthcare providers. For one private hospital we supported on implementing Profitability and Cost Management-PCM (we will call it Hospital 123), this metric had remained out of reach due to fragmented budgeting, inconsistent data sources, and a lack of visibility across departments. That changed when the hospital partnered with Asher to revamp its financial planning process—not through new software, but through structure, ownership, and better use of existing data.

The Challenge: Complexity Without Clarity

The hospital’s finance team was juggling numerous spreadsheets across departments—each with its own format, assumptions, and owners. Budget cycles were delayed, collaboration was weak, and the finance team spent most of its time correcting data and reconciling numbers. There was no clear view of operational drivers, especially when it came to calculating direct and indirect costs per patient.

Without a shared model or standardised methodology, unit cost analysis was guesswork. This limited the hospital’s ability to benchmark costs, assess department efficiency, or forecast the financial impact of changes in patient volume.

The Approach: Structured Planning with Real Operational Drivers

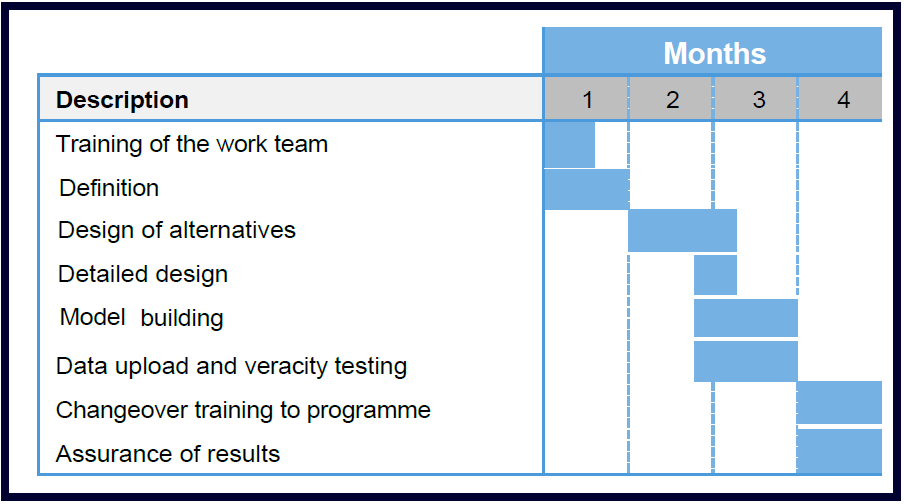

Asher helped the hospital shift from an ad hoc budgeting process to an integrated cost planning model. The goal was simple but powerful: allow the hospital to calculate and monitor cost per patient in real time.

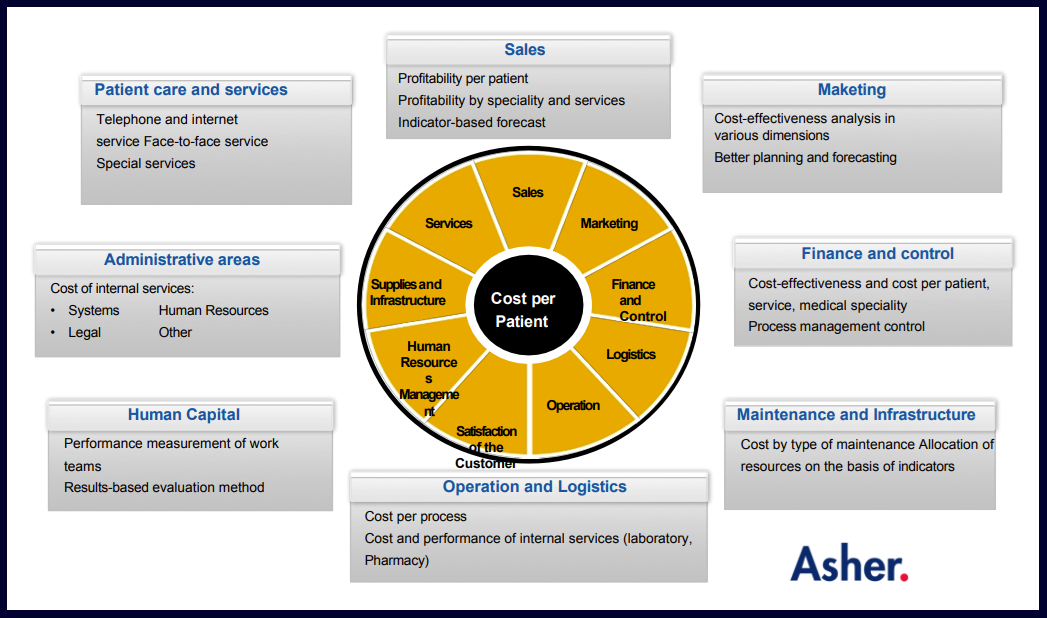

To achieve this, the team implemented a centralised cost allocation model using cost object accounting principles, linking financial data (e.g., wages, medical supplies, overheads) with operational metrics such as patient-days, procedures, and length of stay. Budget owners were trained to enter and monitor their own data, driving accountability and accuracy.

Workshops with medical and finance teams defined cost drivers that truly reflected how the hospital operated. Instead of allocating overheads arbitrarily, the model used real activity-based drivers like staff hours per department or diagnostic volumes—aligning with activity-based costing (ABC) best practices in healthcare finance.

KPIs and Identified Costs

The financial model integrates 3 legal entities and consists of 145 processes, 500 DRGs (Diagnosis-Related Groups), 6 first level clinics and two third level hospitals to serve an estimated population of 10 million people. BI (Business Intelligence), PCM (Profitability and Cost Management), and ERP (Enterprise Resource Planning) software from Oracle and SAP that the customer already had was used.

The Outcome: Clarity, Ownership, and Measurable Cost per Patient

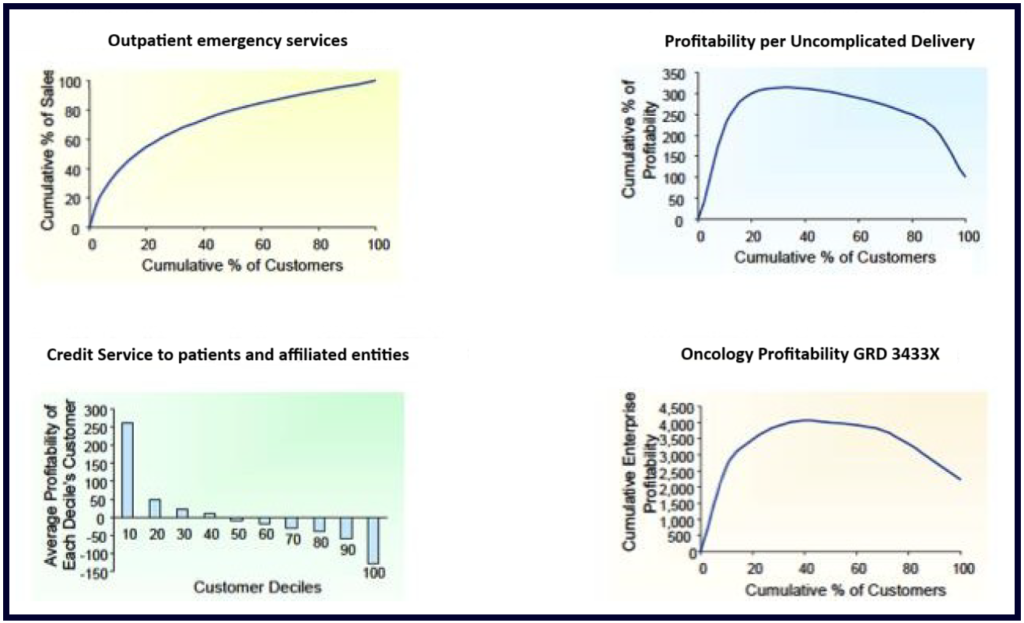

In less than six months, the hospital was able to produce accurate monthly forecasts and calculate the full cost per patient by department, treatment type, and service line.

Executives gained access to reports that showed not only total costs, but how those costs changed with patient volume and clinical complexity. This enabled better contract negotiations with insurers, smarter cost-saving initiatives, and deeper insight into how operational decisions impacted financial outcomes.

The finance team, previously reactive and overwhelmed, became a strategic partner—supporting scenario planning, benchmarking, and performance improvement initiatives.

Why It Matters: Cost per Patient Is the Key to Smarter Healthcare

In an era where efficiency and transparency are critical to healthcare sustainability, understanding cost per patient is more than a financial exercise—it’s a strategic necessity. This hospital proved that transformation doesn’t always require new technology. With the right model and partner, better insights can emerge from the data you already have.