Post-pandemic retail exposed a brutal truth: many stores are still generating revenue, but failing silently. According to BCG and Strategy&, 38% of closures have positive sales but are unprofitable due to poor cost visibility.

Retail leaders are facing a confidence crisis, with only 35% feeling assured in their current growth strategies (Asher & PwC). Traditional metrics, such as average traffic or sales, can hide the accurate picture of profitability, leading to misguided decisions.

Enter Asher Store Profitability: a precision-driven approach enabled by Oracle EPCM – Enterprise Profitability and Cost Management (EPCM), the successor of Hyperion Profitability and Cost Management, Activity-Based Costing (ABC), and Oracle Planning (PBCS) with AI forecasting.

It models profitability store by store and SKU by SKU, revealing actionable insights in near real-time. Layered with generative AI, this model evolves into a strategic engine—optimizing staffing, promotions, and inventory dynamically.

The results? Operating margin gains of 3%–5% and a strategic shift from cutting costs to reallocating capital with confidence.

In this new era, the winners won’t be those who grow fast. They’ll be those who grow profitably.

The Hidden Cost of Success

“38% of the stores we closed last year were growing in sales,” the CFO of a major Latin American fashion chain told me. “They just weren’t making money.”

Across the retail world, many closures didn’t result from a lack of demand. They stemmed from misread signals and outdated tools. When revenue masks unprofitable operations, growth becomes a liability.

In today’s environment, retailers need surgical clarity: the ability to measure profitability per store, understand cost-to-serve, and predict future performance before it happens.

Only 35% of retail leaders report trusting their current growth strategies (Asher & PwC). This isn’t a problem of ambition. It’s a problem of visibility.

The Confidence Gap in Retail Leadership

Most finance and operations teams still rely on averages, lagging indicators, or regional P&Ls. Even when cost targets are hit, BCG shows they often creep back—because the underlying structures remain unchanged.

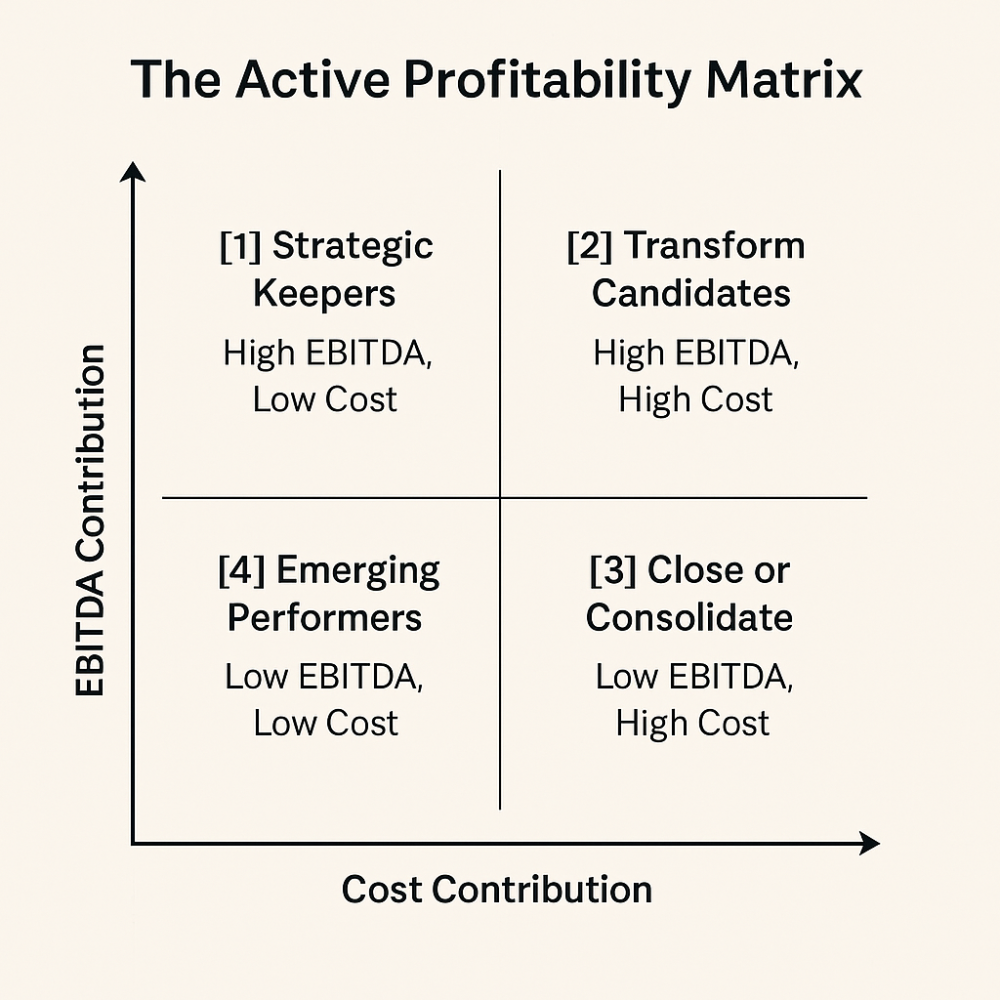

The Active Profitability Matrix

We introduce a new framework for precision decision-making:

This matrix allows leaders to classify every store using real-time data modeled in Oracle EPCM. Each quadrant suggests a different strategy: replicate, optimize, reallocate, or reinvest.

Smart Profitability and Cost Management with Oracle EPCM

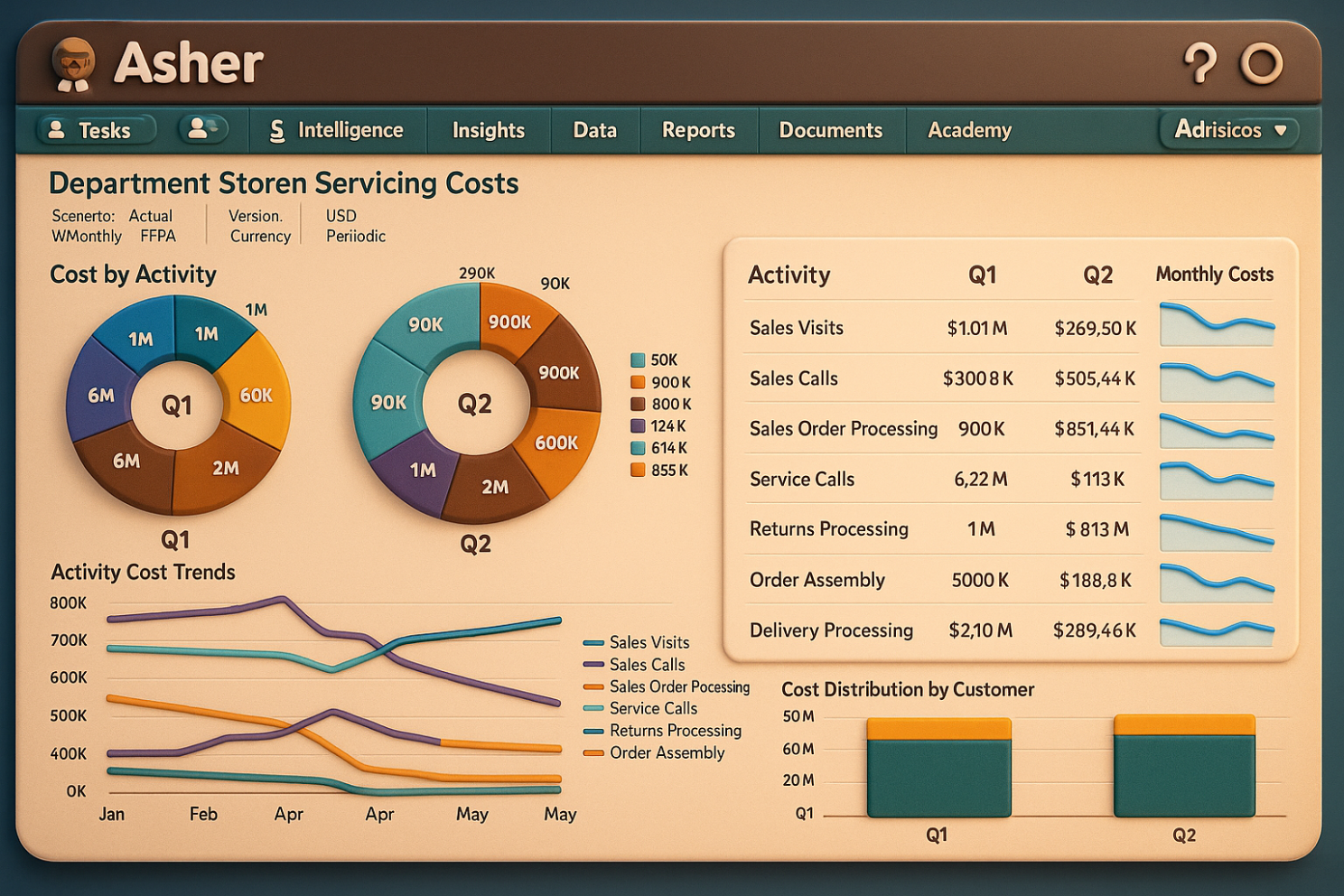

Oracle Enterprise Profitability and Cost Management (EPCM) gives retailers:

- Complete visibility into direct and indirect store costs via ABC.

- Driver-based models that link costs to operations, logistics, and marketing.

- Real-time what-if scenarios for labor, pricing, or lease adjustments.

- SKU-level profitability insights to reimagine the merchandising mix.

Instead of static reports, leaders get a dynamic model of their cost architecture—updated as the business evolves.

When Intelligence Meets Precision: AI Forecasting

When paired with AI Forecasting, Oracle EPCM becomes proactive:

- Predicting staffing needs and customer traffic at the hyperlocal level

- Recommending promotion calendars based on behavioral data

- Suggesting replenishment strategies aligned with real demand

Now, instead of asking “how do we reduce expenses?”, leaders ask: “how do we prevent inefficiency before it hits the P&L?”

Case Study: How ModaNova Rewrote Its Strategy

ModaNova, a regional fashion retailer, used Oracle EPCM to analyze store-level performance. The findings:

- 22% of stores had positive comps but negative EBITDA.

- Lease renegotiations and staffing adjustments increased margins in 70% of targeted stores.

- A test location outperformed a flagship store due to lower cost-to-serve.

Within 18 months, ModaNova moved from expanding its footprint to optimizing its contribution. Operating margin rose 4.1%. Online sales doubled thanks to AI-informed inventory allocation.

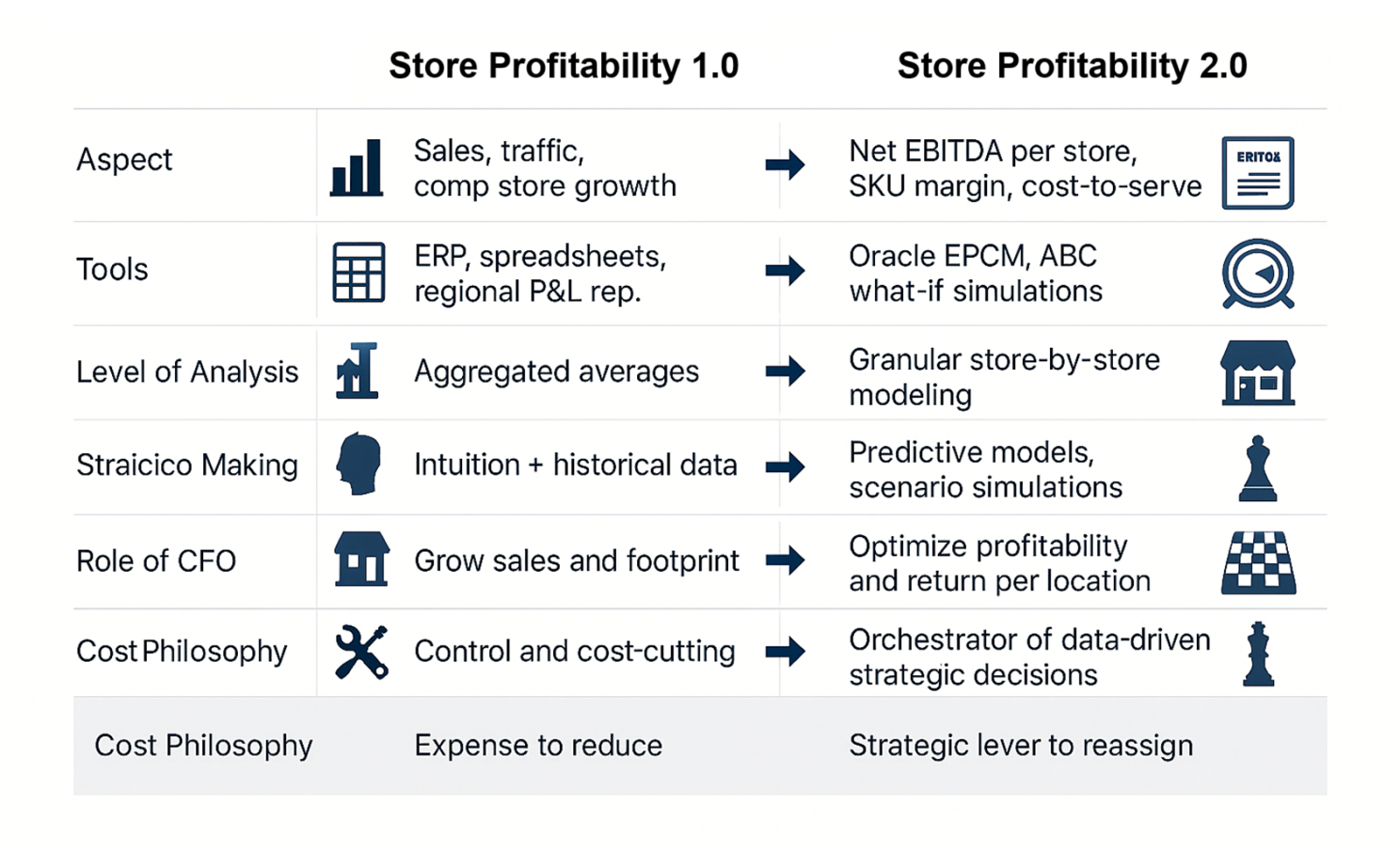

What Makes Store Profitability 2.0 Different?

- It doesn’t chase volume—it targets contribution.

- It doesn’t reduce cost blindly—it reallocates it smartly.

- It doesn’t use static reports—it simulates future outcomes.

Boardroom Questions: Are You Ready?

- Which stores drive EBITDA, and which destroy value?

- Are we modeling cost-to-serve in Oracle EPCM or relying on regional averages?

- What scenarios are we simulating before making a cut or investment?

- How is AI helping us predict demand and align resources?

- Have we redesigned incentives to reward profitability, not just sales?

Final Takeaway

Store Profitability 2.0 is not a vision for the future. It’s the current operating model.

Retailers that implement Oracle EPCM and ABC move from cost containment to strategic orchestration. They build margin resilience. They grow with intent.

Because the future isn’t about growing fast, it’s about increasing right.

Let’s talk

Write to info@fpanorge.com and let’s start talking about your own Success Story of Store Profitability 2.0.

References and Further Reading

- BCG (2023). Effective Cost Control Can Fuel Company Growth. Boston Consulting Group.

- PwC (2023). Retail Cost Management Guide for Leaders. PricewaterhouseCoopers.

- Strategy& (2023). The Impact of GenAI in the Retail Industry. A PwC Network Member Firm.

- Oracle (2023). Oracle Enterprise Performance Cost Management Overview.

- Pedro San Martín (2010). Cost to Serve: Transforming Financial Information into a Value Lever. Capgemini Spain, Financial Innovation Center.

- CPEY (1994). Activity-Based Costing for Food Wholesalers and Retailers. Joint Industry Project on Efficient Consumer Response.

About the Author: Pedro San Martín is an expert in Strategic Finance and Organizational Transformation, helping companies unlock sustainable competitive advantages through more innovative resource management.